|  | |

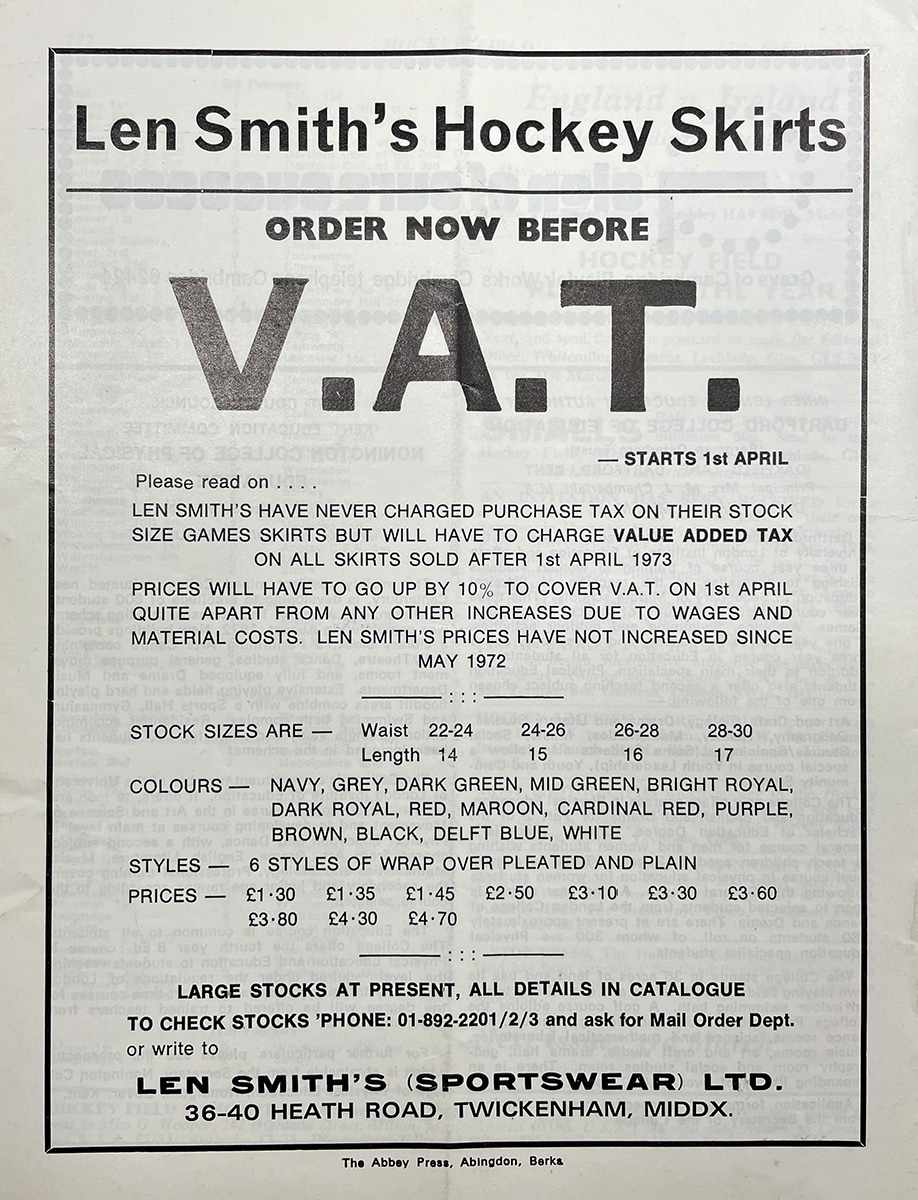

| Len Smith’s was a renowned shop in Twickenham, Greater London, which sold women’s sporting attire to hockey clubs. It is perhaps most famous for its skirts (pictured), even fitting out the England national team. | ||

The introduction of Value-added tax (VAT) into the UK on 1 April 1973, with a VAT rate of 10%, had special significance for treasurers of sports clubs, who had to grapple with how the uncertainties and complexities of a new system might impact on their club. A new language was created, including terms such as taxable, exempt and zero-rated supplies, thresholds, inputs and outputs. A decision needed to be made whether each club needed to register for VAT, and if it did, how it would deal with the administrative burden of keeping the necessary accounting records and filing quarterly VAT returns.

The basic rule was that if a club’s annual taxable supplies exceeded the VAT threshold (initially £5,000) then it had to register for VAT. Two key sources of income for most clubs, members subs and bar receipts, were taxable supplies but donations were not. If a club did register for VAT, charging its members VAT on their subs and at the bar, it could offset its VAT payment by deducting VAT incurred on many, but not all, its purchases – a new set of rules for what could be deducted had to be learned.

Some hockey clubs were able to split their activities into two different clubs, such that neither club reached the threshold: typically, a club which focused on playing hockey in which the main income was members’ subs, and a social club in which its members enjoyed the bar and social events. This increased the administrative burden as the two clubs had to be seen to be run separately, with their own constitutions, committees, bank accounts and paid memberships.

There were many changes to the VAT rate and to the threshold. It was a great relief to hockey club treasurers when, on 1 April 1994, when VAT was 17.5% and the threshold £45,000, the rules were amended to exempt supplies of sporting services made by non-profit organisations engaged in sport or physical education. In particular, this meant that members’ subs and hiring sports equipment and facilities to members were no longer considered to be taxable supplies.